Backlog Accounting procedures have become a major challenge for commercial organisations that must be avoided. Small business units fail to keep good accounting records and consequently lose control over the data, resulting in a massive loss. In such cases, you might seek assistance from an expert staff that specialises in this subject.

Furthermore, an organisation that does not keep good accounting records and intends to have systematic accounting would have to put in a lot of effort to analyse and record previous transactions.

We can consider a full book of accounts and work on it for several years, producing financial statements and many sorts of internal management reports. Hiring an accountant to clear the backlog of work might take a long time if the accountant was not efficient and experienced.

Backlog accounting is a method of recording and accounting for incomplete transactions or orders. It comprises orders that have been placed but have not yet been dispatched, services that have been ordered but have not yet been provided, and work that has started but has not yet been completed.

A backlog is a collection of accounting records that must be finished as part of financial management. Backlogs reflect revenue that is available for the company but is not generated due to a variety of factors such as workload, an increase in orders that cannot be handled by the organisation, and ineffective financial management. Creating financial reports allows you to understand the fundamental cause of the backlog and make the necessary modifications.

Monitoring the company’s backlogs is critical. Unacquired backlogs may depreciate, resulting in limited sales and lower sales volume. Backlogs have a significant impact on the company’s future revenue since they determine the company’s incapacity to meet demand.

Businesses may plan production schedules, allocate resources, monitor cash flow, and guarantee that client orders are completed on time by managing backlogs. This enables firms to run more efficiently and effectively, thus increasing profitability and customer happiness.

As a result, businesses outsource backlog accounting to any reputable accounting firm for effective backlog accounting services.

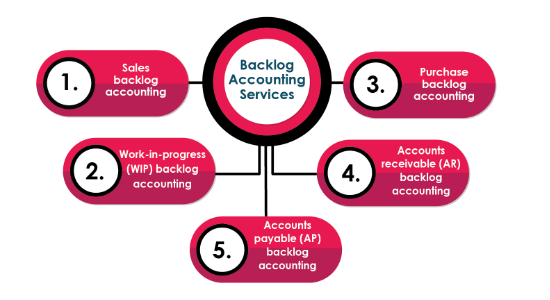

Backlog accounting services vary since different firms have distinct demands and requirements when it comes to managing their backlogs. Accounting companies and specialists can adapt to the specific needs of various businesses and industries by delivering various forms of backlog accounting services.

This entails keeping track of sales orders that have been received but have yet to be fulfilled. Sales backlogs can assist organizations in planning production schedules, allocating resources, and managing inventory levels.

This entails keeping track of purchase orders that have been placed but have yet to be completed. Purchase backlogs can assist firms in managing cash flow, tracking spending, and ensuring that goods and supplies are readily available when needed.

This entails keeping track of unpaid invoices that have yet to be collected. AR backlogs can assist firms in managing cash flow, tracking customer payments, and ensuring that outstanding invoices are collected on schedule.

This entails keeping track of unpaid debts that have yet to be paid. AP backlogs can be used to assist organization’s in managing cash flow, tracking costs, and ensuring that overdue bills are paid on time.

Backlog accounting services are those that record and manage prior financial transactions that have not been processed or completed. The steps involved in backlog accounting services are as follows:

We identify neglected tasks to be completed as the first step in controlling the backlog. The phase also includes a review of financial statements, invoices, and similar financial records to analyse the duties that were left unfinished throughout the usual accounting cycle.

In this section, we distribute the necessary resources to finish the backlog activities, which may include recruiting additional staff or contractors, reassigning existing personnel, or outsourcing some duties to third-party service providers.

We must implement the strategy successfully and efficiently once it has been developed. The procedure entails delivering quality training to employees, establishing new procedures or systems, and constantly monitoring progress.

We create a strategy to finish the backlog work at this step, which includes dates, milestones, and performance standards. Following that, the plan is disseminated to key stakeholders such as top management, finance executives, and other internal stakeholders.

Once all of the tasks in the backlog have been done, the results must be reviewed to ensure accuracy and completeness. This comprises bank reconciliation statements, ensuring that all statements are processed, and creating financial statements.

Once all of the tasks in the backlog have been done, the results must be reviewed to ensure accuracy and completeness. This comprises bank reconciliation statements, ensuring that all statements are processed, and creating financial statements. To summarise, regardless of the situation, we must solve backlogs because they have an impact on the company’s agendas and sales. Backlogs should be considered as part of the productive analysis and prevented with efficient ways.

Forthrightconsultancy ensures that all of your financial needs are met. Our team assists you with document and accounting record maintenance so that you do not miss critical dates or face a backlog. Our staff also examines the backlog ratio and attempts to improve it.

Forthright Consultancy main areas of concentration include corporate finance, risk management, accounting & bookkeeping, audit & assurance, and tax consulting & compliance. We have a diverse clientele that ranges from small business owners to medium-sized organisations. Small- to medium-sized-to-large entrepreneurial firms are our main target market. We are comfortable working with small and medium-sized family-owned businesses, though. Because our clients are very business-minded, we are sensitive to their unique demands and requirements and adaptable in our approach and deliverables.

Accounting Advisory Services to Help You Grow Your Business

Accounting Advisory Services to Help You Grow Your Business PRO Services in Dubai

PRO Services in Dubai “A Complete Guide To Understanding Corporate Tax In UAE”

“A Complete Guide To Understanding Corporate Tax In UAE” In Country Value Certificate in Dubai Assurance & Audit Services In UAE

In Country Value Certificate in Dubai Assurance & Audit Services In UAE Which is Best Bookkeeping Service in Dubai

Which is Best Bookkeeping Service in Dubai  Unveiling Dubai’s Financial Compass: Navigating Growth Through Cost Audit in dubai

Unveiling Dubai’s Financial Compass: Navigating Growth Through Cost Audit in dubaiDubai Fahidi heights Al hamriya | London DA16 3DJ Welling

Copyrights 2022 Forth Right. All Rights Reserved.